ventura property tax due date

Pay by eCheck to receive an immediate emailed paid receipt. 10 of the next year it automatically postpones your delinquency date to give you at least 21 days to pay your taxes.

Ventura And Los Angeles County Property And Sales Tax Rates

The second installment is due February 1 and becomes delinquent if not paid by April 10.

. Property taxes levied for the property tax year are payable in two installments. The Texas Comptrollers property tax calendars include important dates for appraisers taxpayers and professionals. 2nd Installment is due February 1st delinquent after April 10th.

The biggest penalty of the year hits for those in delinquency. In the two to three. Last day to pay your property taxes without incurring financial penalties and interest charges.

The first installment is due September 1 of the property tax year. Secured Property Taxes in Ventura County are paid in two installments. The Second Installment of Ventura County 2020-21 Secured Property Taxes was due February 1 2021.

If you receive a tax bill for the previous year postmarked after Jan. A 25 percent discount is allowed for first-half property taxes paid before September 1 and for second-half property taxes paid before March 1. Taxing units must set.

First day to file affidavit and claim for exemption with assessor but on or before 500 pm. The first is due November 1. It becomes delinquent if not paid by December 10.

As of July 1 2022 any unpaid Secured Tax Bills from 2021-2022 fiscal year are now defaulted and CANNOT BE PAID ONLINE. Taxes become a lien on all taxable property at 1201 am. Appraisal districts must have their budgets set for the next year.

Pursuant to the Executive Stay at. County of Ventura - WebTax - Search for Property. Ventura County has one of the highest median property taxes in the United States and is ranked 123rd of the 3143 counties.

Ventura County collects on average 059 of a propertys assessed fair market value as property tax. Chief appraiser must extend deadline. The second installment is due March 1 of the next calendar year.

If December 10 or April 10 is a Saturday Sunday or legal holiday the delinquency date is the following business day. Or email questions to. When December 10th or April 10th falls on a Saturday Sunday or legal holiday the delinquency date is the next business day.

Fourth installment of payment plan is due for those who qualified. 1st Installment is due November 1st delinquent after December 10th. For more information go to.

Taxes paid after April 12 2021 will be assessed a late payment penalty fee of 10 plus a 30 cost. Receive Ventura County Property Records by Just Entering an Address. The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700.

Last day for the chief appraiser to notify the taxing units of the form in which the appraisal roll will be provided to them Sec. Last day to file renditions and property reports on most property types. Secured Tax bills for the new fiscal year 2022-2023 will be available in October 2022.

Annual secured property tax bill that is issued in the fall. Pay Your Taxes - Ventura County. DUE DATES - Ventura County.

Taxing authorities include Ventura county governments and various special districts such as public schools. Ad One Simple Search Gets You a Comprehensive Ventura County Property Report. Along with collections property taxation encompasses two additional overarching functions which are formulating real estate tax rates and conducting assessments.

Prepare Tax Form 1120 For Problem Below Tax Chegg Com

Ventura Motel 95 1 3 5 Prices Reviews Ludington Mi

Ventura County Ca Property Tax Search And Records Propertyshark

%20(002)NEOGOVWEBSITE.png?upscale=True)

Promotional Opportunities Sorted By Job Title Ascending Welcome To The County Of Ventura

Supervisor Kelly Long County Treasurer Tax Collector Announces Penalty Waivers After April 10 Ventura Calif Steven Hintz Ventura County S Treasurer Tax Collector Announced Today That Beginning April 11 2020 He Will Accept

Printable Conference Registration Receipt Template Sample Receipt Template Registration Form Sample Youth Conference

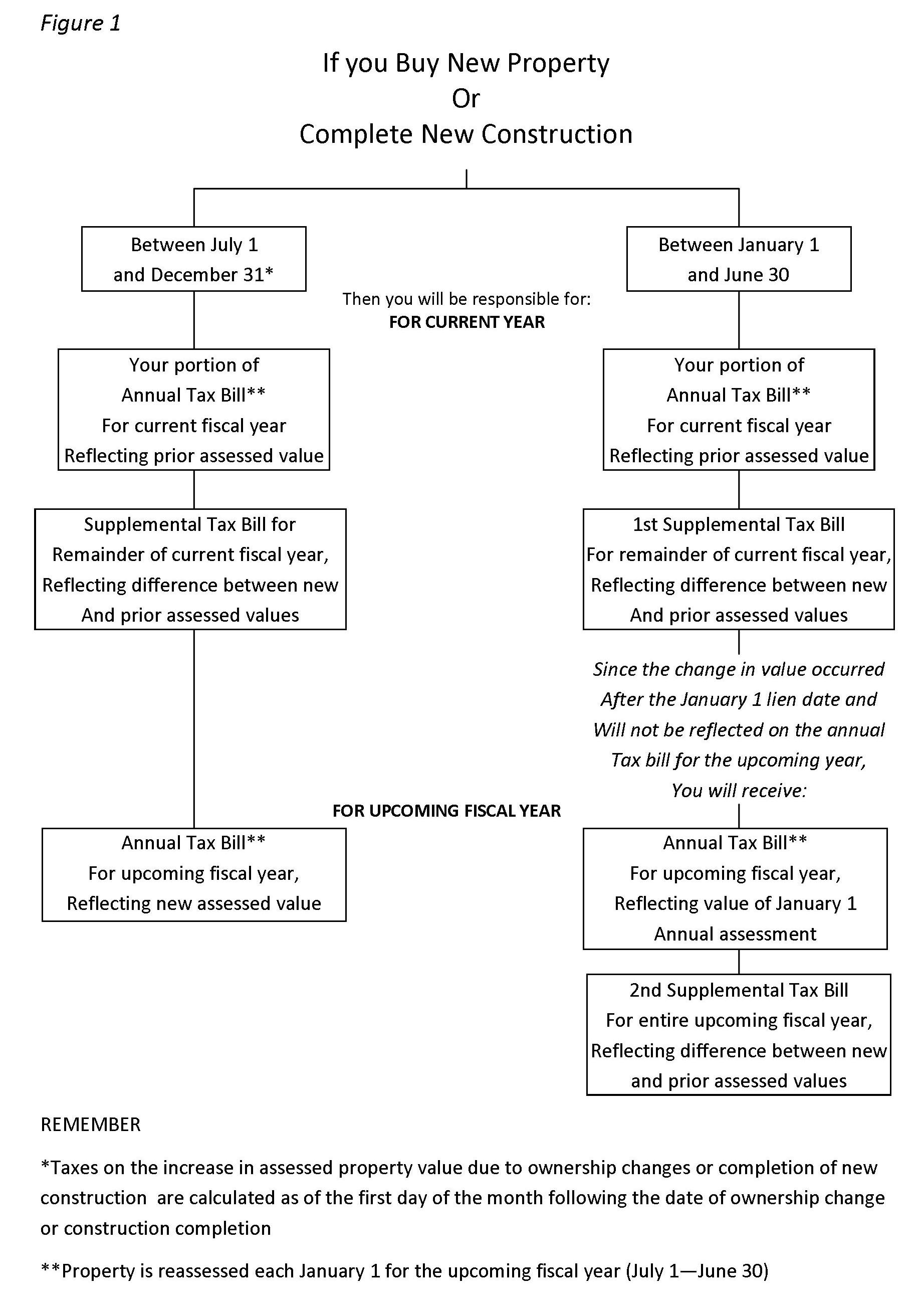

Ventura County Assessor Supplemental Assessments

Aug 20 Bilingual Update Ventura County Invites Job Seekers With Military Experience And Employers To The Military And Veteran Job Fair And Expo Amigos805 Com

Pay Property Taxes Online County Of Ventura Papergov

Pay Property Taxes Online County Of Ventura Papergov

Ventura Ii Emblem Michael Peever Auctions

Securedsupp Billing Illustration Ventura County

See Best Offers For The Ventura Grand Hotel In Bangalore Great Deals Await